All goods imported into malaysia are subjected to duties andor gst. The bad debt relief processed and saved will be listed on the grid section for user view and track User can double click on the record line to view the list of outstanding invoices selected for the bad debt relief processing o Open.

And iii The bad debt relief shall be claimed immediately in the taxable period after the expiry of the sixth month from the date of supply.

. Under purchase there is also bad debt relief where business did not do payment for supplier. Total Output Tax Inclusive of Bad Debt Recovered other Adjustments 52. Dear Community Memebers I am struggling with the handling of GST for Bad Debt in Malaysia.

User Access Right Assignment Request Add Option for Mark All and Clear All. And b the supply is made by a GST registered person to another GST registered person. How Bad Debt Relief Works.

Bhd Apple with a principal value of RM1000 and a standard rated GST of RM60. Check the document to claim bad debt relief. Combine Your Debt Into One Loan.

E goods or services made in Malaysia or any supply made outside Malaysia which would be a taxable supply if made in Malaysia. GST-SG Purchase Returned with TXRC tax code should post as negative value in GST Return 5618. You have supplied goods or services for a consideration in money and have accounted for and paid GST on the supply.

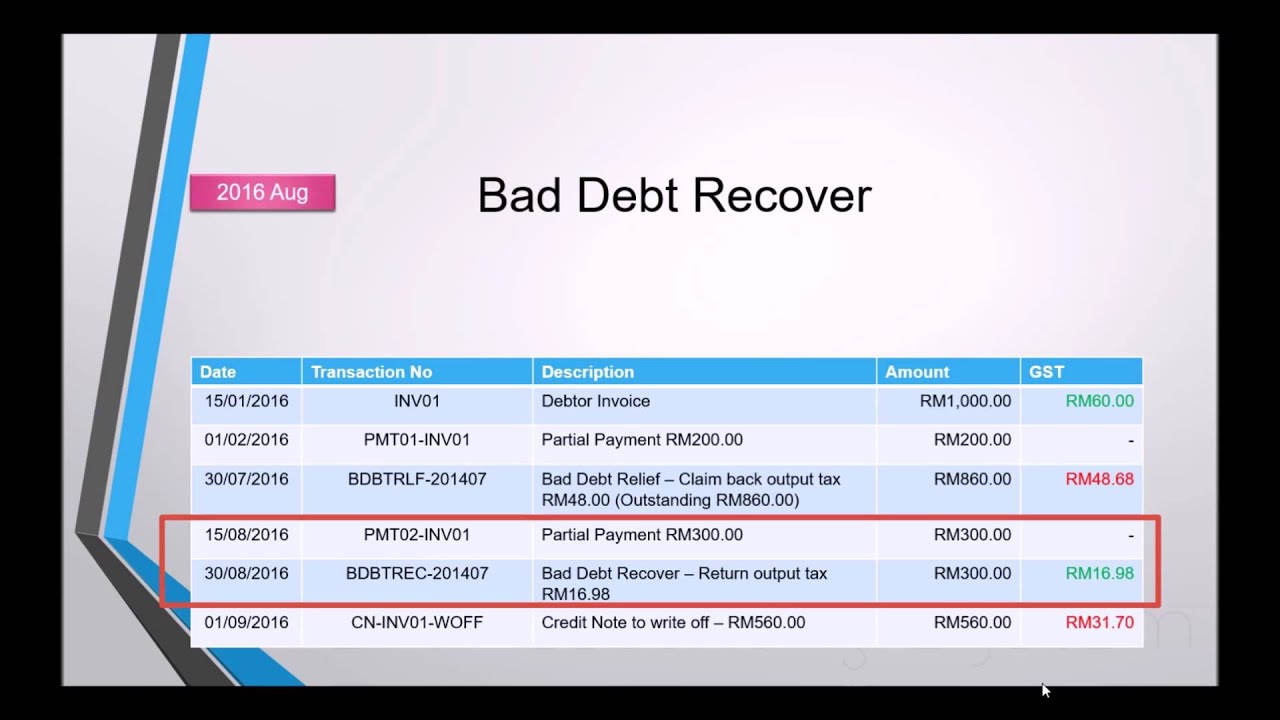

You can apply for bad debt relief from the Comptroller of GST for return of the output tax previously accounted for and paid by you. Track Bad Debt Recovered- Once customer return a payment system could identify it as a bad-debt and then recover it. Perspectives in analysing the Panel Decision GST Act Regulations and GST Guide on Tax Invoice and Record Keeping Time-dimension in sufficient efforts Legal safeguard under Section 583 and complying with Panel Decision in good faith Bad debt relief.

You have to meet the following conditions to qualify for bad debt relief. If user decide not to claim the GST bad debt relief they can choose to untick it. Dr Bad Debt 200000 Dr Input Tax 12000 Cr Debtor 212000 If the customer pay you after you have claimed the Bad Debt relief from the Kastam You to do the following accounting entry- Dr Bank 212000 Cr Bad Debt Recovered 200000 Cr Output Tax 12000 Conclusion.

1800 887766 4 102. Obtain GST registration number from customer who already registered under GST Act. Hipster issued a tax invoice on 15th May 2018 to Apple Sdn.

A taxable person may claim bad debt relief subject to the requirements and conditions set forth under sec58 of the gsta 2014 and the person has. Output Tax has to be reported either upon Invoice or Collection whichever comes first. Total Value of Capital Goods Acquired.

Pin On Stretching Before After Running In normal situation you should claim bad debt relief on. My understanding is that in the case of Output GST the declared amount of an invoice could be claimed after six months if the invoice is not paid by the customer the same applies vice versa for vendors. Total Value of Exempt Supplies.

Is a GST registered shoe manufacturer and purchased leather from Kulit Sdn. Total Input Tax Inclusive of Bad Debt Relief other Adjustments 62. Total Value of Export Supplies.

Bhd a registered person worth RM50000 and incurred GST at RM2000. Thus a business will need to report and pay the Output Tax once an Invoice is. Get Out of Debt.

11 rows Item 1Motorcar used exclusively for the business purpose as approved. Compare Rates and Find The Right Lender. 1 subject to regulations made under this Act any person who is or has ceased to be a taxable person may make a claim to the Director General for a relief for bad debt on the whole or any part of the tax paid by him in respect of the taxable supply if.

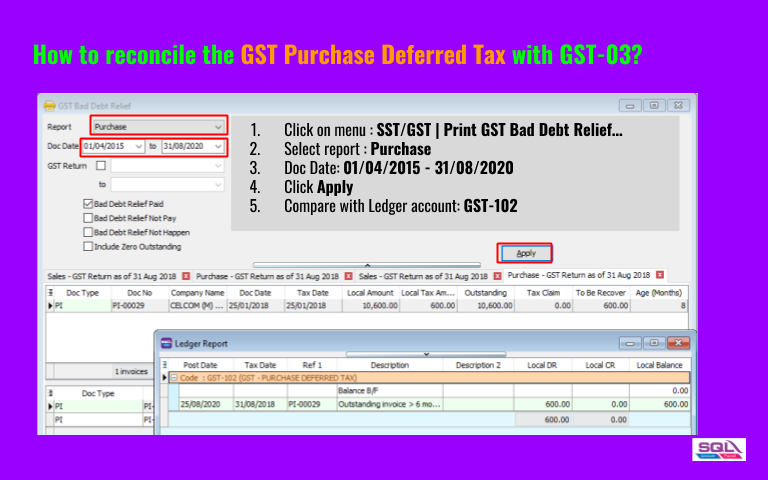

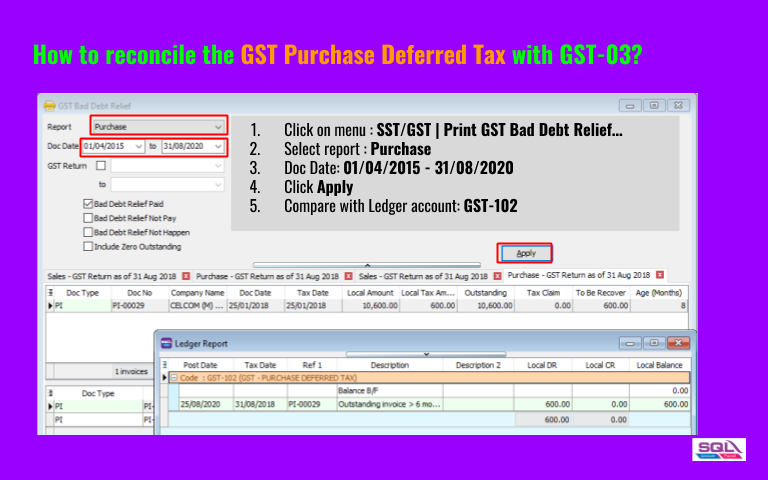

Obtain GST registration number from customer who already registered under GST Act. To address these ambiguities the royal malaysian customs department rmcd. The Bad Debt Relief function is located at Accounting Journal Entry GST Bad Debt Journal AR Bad Debt Relief Bad Debt Relief Listing screen.

Major factors considered are. A requirements under s58 GSTA and Part X of GST Regulations 2014 are fulfilled. Ad Use Our Comparison Site Find The Best Debt Consolidation Companies.

Comparison between GST and Income Tax Marriage of new. Output Tax has to be reported either upon Invoice or Collection whichever comes first. Athe person has not received any payment or part of the payment in.

GST Malaysia Bad Debt Recovered Relief. You have written off the whole or any part of the consideration for the supply as a bad debt in your accounts. Note that it is six calendar months and not 6 months from date of invoice.

Thus a business will need to report and pay the Output Tax once an Invoice is issued rega. Look for Customer Aging Report Detail to identify which customer owed us more than 5 months month of six. Example 3 Hipster Sdn.

If user decide not to claim the GST bad debt relief they can choose to untick it. This is the total amount you can claim back from Kastam for bad debt relief. BAD DEBT RELIEF Section 58 1 GST Act 2014 Subject to regulations made under this Act any person who is or has ceased to be a taxable person.

If you account for goods and. The tax relief measures include a zero percent rate of VAT on bread and an increase in the tax credit for families with children from BGN4500 per year to BGN6000 in addition to discounts on fuel. Determine gst bad debt relief.

After 29th December 2018 a registered person who is entitled to a bad debt relief under Section 58 GSTA is allowed to claim bad debt relief by amending his final return.

Yyc Advisors If The Bad Debt Relief Is Not Claimed Immediately After The Expiry Of Sixth Month Then The Taxable Person Has To Notify The Director General Dg Within 5 Days

This Time Really Final Date 31 08 2020 Amending Your Final Gst 03

Gst Bad Debt Relief Madalynngwf

This Time Really Final Date 31 08 2020 Amending Your Final Gst 03

Gst Bad Debt Relief Madalynngwf

Gst Bad Debt Relief Madalynngwf

Gst Sales Purchase Deferred Tax Journal Adjustment Estream Software

Gst Bad Debt Relief Madalynngwf

Gst Bad Debt Relief Madalynngwf

Newsletter 22 2019 Gst Guide On Transition Issue Page 002 Jpg

Pin By Ginger Twig On Lord Of The Rings The Hobbit Really Funny Pictures Really Funny The Hobbit

Update On Malaysia Gst Form 03 Report Solarsys

Globla Indirect Tax Services Kpmg Global

Sage Ubs Managing Bad Debt Youtube